EMPLOYEES MAKING LESS THAN $35,568 ELIGIBLE FOR OVERTIME BEGINNING JANUARY 2020

As we have been advising for the last few years, the Department of Labor (DOL) has been working on updating the salary threshold for overtime pay under the Fair Labor Standards Act (FLSA). Today, it issued its final rule, which will go into effect on January 1, 2020.

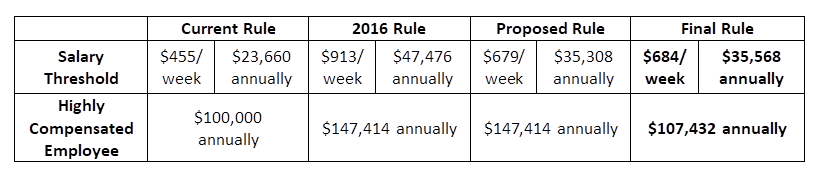

The salary threshold below which employees will be subject to overtime pay will raise to $35,568 per year ($684 per week). This is a vast improvement from the threshold proposed under the Obama Administration, which would have doubled the current threshold. The current threshold, which has been in effect for 15 years, is $23,660 per year ($455 per week).

This change to the salary threshold means that employees making less than $35,568 per year will be subject to overtime beginning January 1, 2020. This will include many employees who were exempt under the previous threshold.

To prepare for the new salary threshold, employers should look at their current salary data and determine which employees fall below the new salary threshold. For those employees, employers will need to determine the best course of action for their business: raise employees’ salaries above the new threshold to maintain the exempt status (assuming all other requirements are met) or reclassify the position as non-exempt and pay overtime when overtime is worked.

Meeting the salary threshold is just part of the equation. In addition to reviewing employee salary data, employers should look closely at employees’ job duties to ensure they meet the requirements for exemption. Misclassification is one of the most common violations of the FLSA; if employers are reviewing salaries for exemption, they should make sure they review job duties as well.

Need help? Nevada Association of Employers provides a helpful checklist to assist members with making the determination whether an employee is exempt from the minimum wage and overtime requirements of the FLSA or not.

In addition to raising the salary threshold for overtime pay, the DOL’s final rule also raises the threshold for being considered a “highly compensated” employee. Currently, the threshold is $100,000. Beginning January 1, 2020, the threshold will raise to $107,432 (of which $684 must be paid weekly on a salary or fee basis).

While the new rule doesn’t provide for automatic adjustments to the salary threshold — something that would have been the case under the Obama Administration’s rule — the DOL states that it intends to update the thresholds more regularly in the future. Therefore, employers should anticipate seeing increases to the salary threshold in the future and should plan accordingly.

Nevada Association of Employers has been monitoring the latest developments with the change to the salary threshold and will continue to do so to ensure members have the latest information to remain compliant. Nevada businesses trust that they are getting the latest information on their rights and obligations from NAE because it’s what we do. For more information about NAE and what we do for Nevada employers, visit our website. If you are a Nevada employer interested in membership, please contact membership@nevadaemployers.org or join today!

Mailing List Sign Up Form

Fill out this mailing list sign up form to receive monthly email updates on the latest NAE news, HR issues, special events, training dates and more!